Company Income Tax Rate 2024

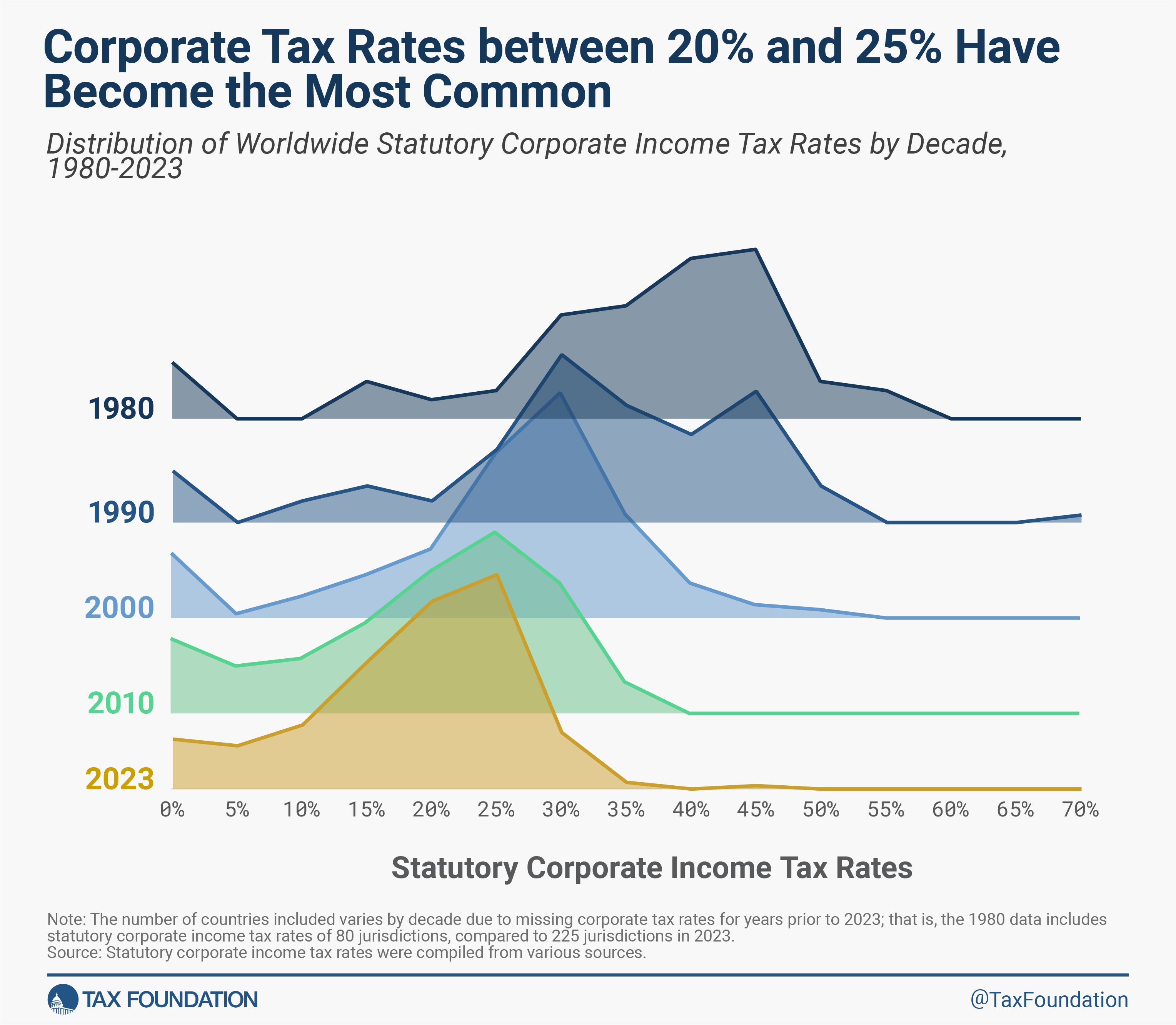

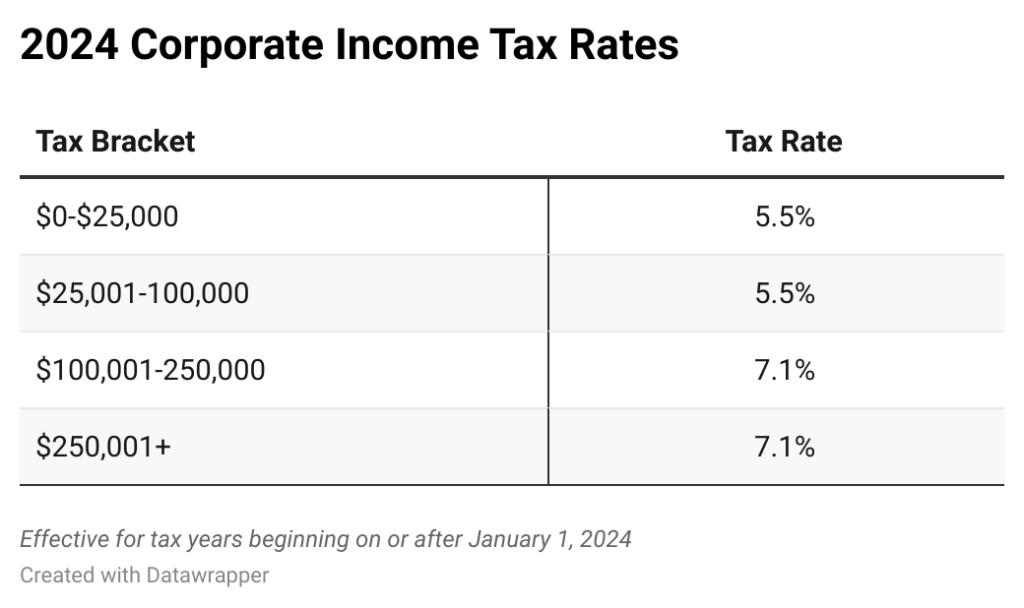

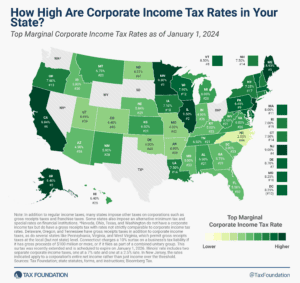

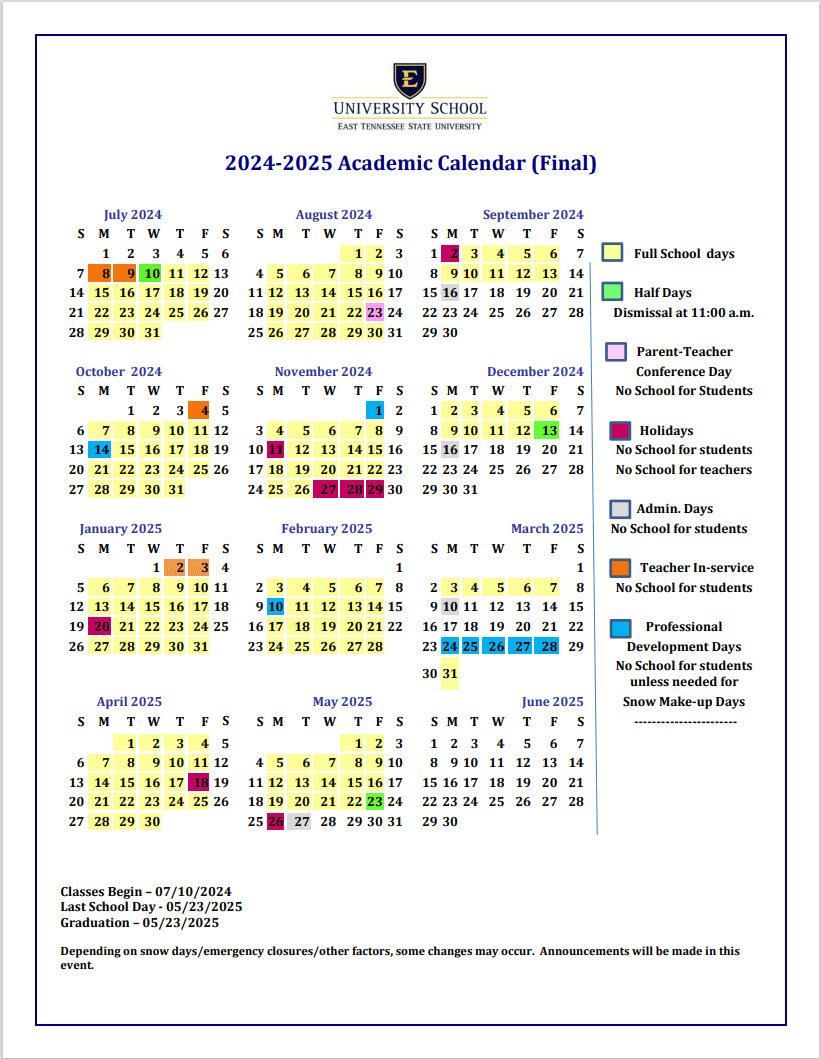

Company Income Tax Rate 2024 – The taxes are split between you and your employer, so you’ll only see payroll tax rates of 6.2% withheld for Social Security and 1.45% for Medicare, and your company pays the remainder the max . For the 2024 tax year, six states are making changes to the top marginal rate for corporate income tax. In all cases, corporations will be able to take advantage of a reduction in the rate. Scroll .

Company Income Tax Rate 2024

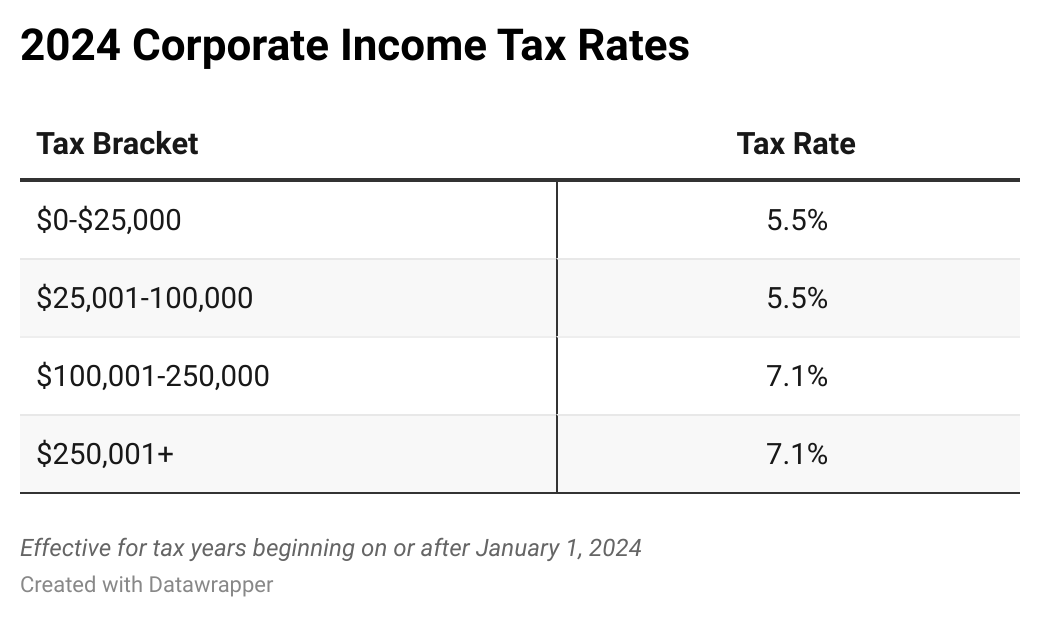

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

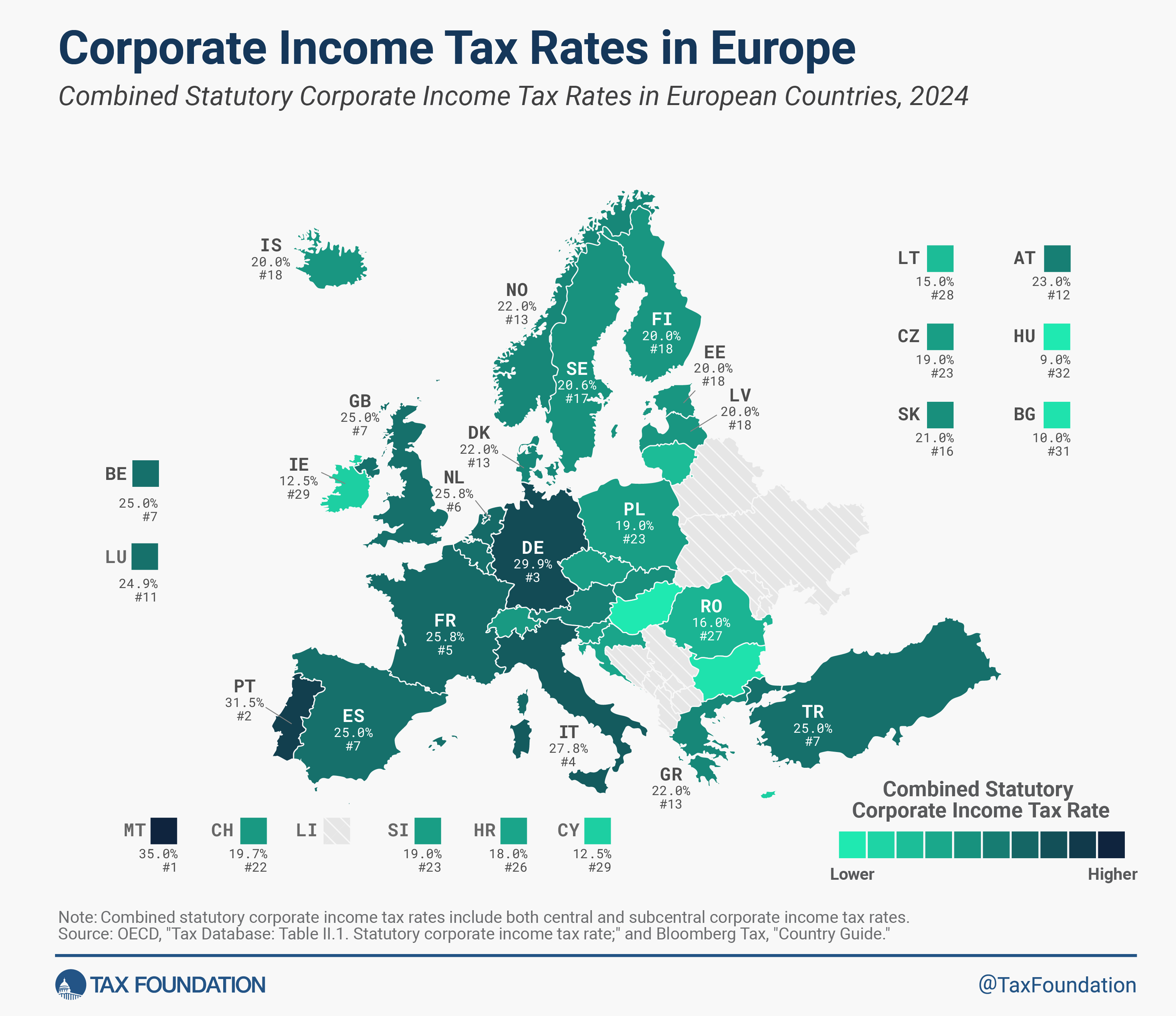

Source : itrfoundation.org2024 Corporate Income Tax Rates in Europe | Tax Foundation

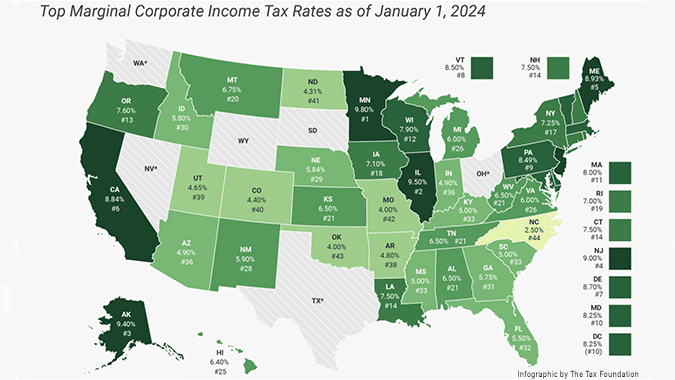

Source : taxfoundation.orgWhich States Have the Highest Corporate Taxes in 2024? NJBIA

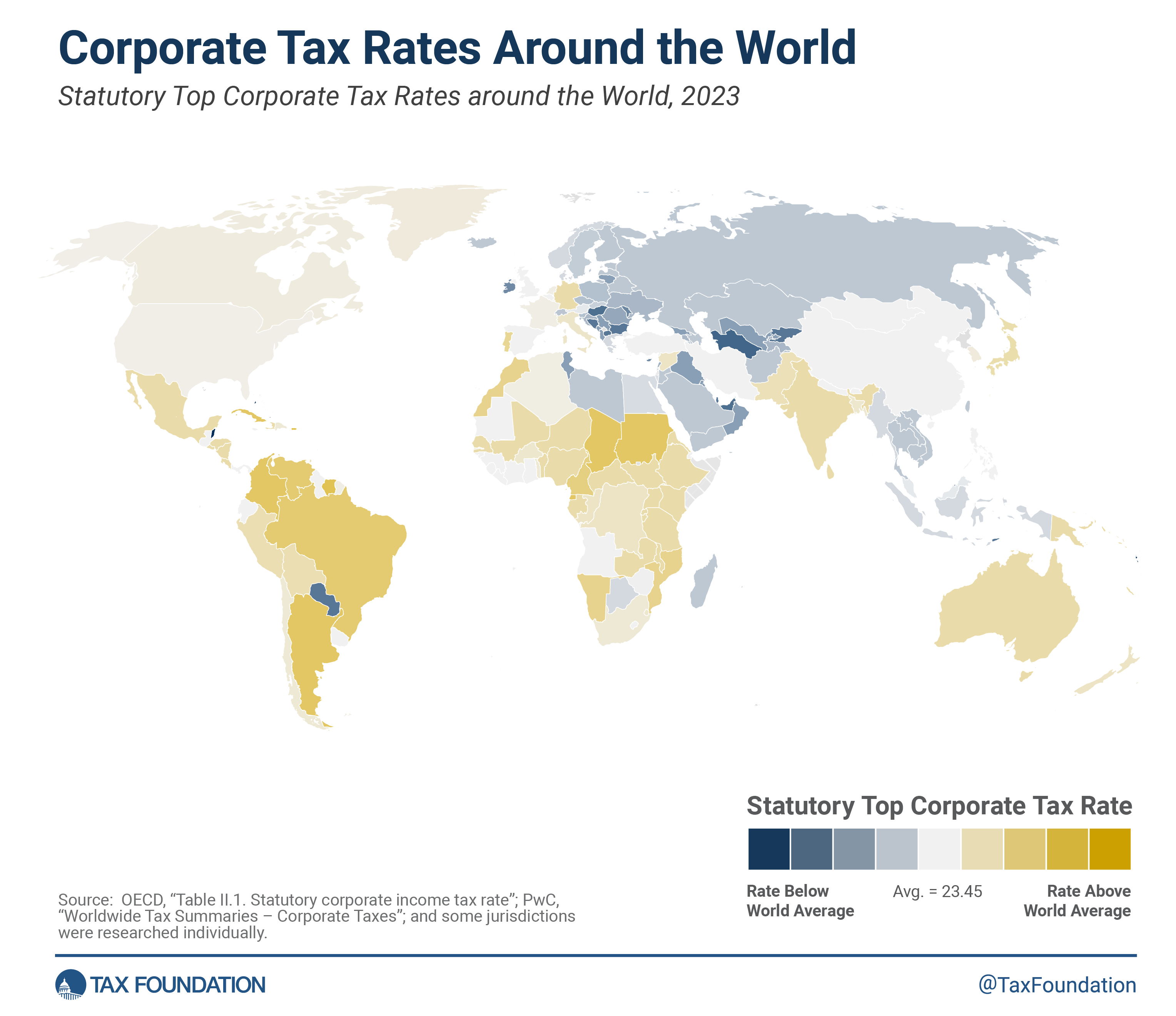

Source : njbia.orgCorporate Tax Rates around the World, 2023

Source : taxfoundation.orgYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.comCorporate Income Tax Definition | TaxEDU Glossary

Source : taxfoundation.orgIowa Will Have a Lower Corporate Tax Rate in 2024 ITR Foundation

Source : itrfoundation.orgCorporate Income Tax Rates and Brackets Archives | Tax Foundation

Source : taxfoundation.org2023 State Corporate Income Tax Rates & Brackets | Tax Foundation

Source : taxfoundation.orgCompany Income Tax Rate 2024 2024 State Corporate Income Tax Rates & Brackets: She has spent the last year and a half working at a software company, managing content about CRMs who make $1,500 or more throughout the year. The FUTA tax rate is 6% on the first $7,000 in income . A bill that would have lowered the state income tax rate failed in committee Monday, although it may not be the last attempt this session. House Bill 24-1065 as introduced would have reduced both the .

]]>